PHOTOS: Bernie Madoff, US Marshals Service

Subasta de pertenencias de Bernie y Ruth Madoff.

400 artículos de lujo.

US MARSHALS

Department of Justice.

•Steinway and Sons grand piano with bench: Model M, serial number 188880, circa 1917. Diagonally measures 6’2″, 38.5″ height.

•18 pairs of men’s Belgian shoes, Mr. Casual style, size 9W

•Slippers: 1 pair black velveteen slippers, size 8½, red quilted lining, «BLM» embroidered with gold thread.

Aquí, todos los objetos.

Gaston&Sheehan

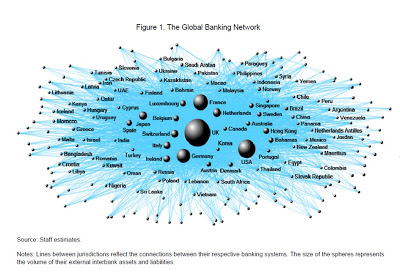

MAPS: La red bancaria mundial, FMI

La red global bancaria.

Integrating Stability Assesments Under The Financial Sector Assessment Program into Article IV Surveillance

FMI

Notes: Lines between jurisdictions reflect the connections between their respective banking systems. The size of the spheres represents

the volume of their external interbank assets and liabilities.

GRAPHICS: 32% de déficit, Irlanda

The Irish Times

Rescate a la banca: 50.000 millones de euros.

Déficit: 32% del PIB.

Objetivo 2014: 3% del PIB.

El reparto de la lluvia de millones.

A 32% Deficit? How It Happened

Ireland’s latest bank rescue has sent its projected budget deficit for this year soaring to 32% of its economic output—the highest ever for a euro-zone country in the club’s history. So, what happened?

Ireland Thursday said the final cost for fixing its banks could reach as high as €50 billion over time—more than the €33 billion officials had already committed.

In response, Ireland is taking all the pain at once—which is why its deficit is surging so much higher than the previously expected 12% of gross domestic product this year. The goal: To bring finality to its banking woes and get on the right side of rules for euro-zone members.

Many economists expect the deficit to shrink next year, possibly to the low double-digits. Irish officials are trying to cut it to 3% by 2014, meeting a European Union requirement. But that will depend on three things: the performance of Ireland’s fragile economy; how much investors charge the country to borrow; and how much Ireland’s harsh austerity measures hurt consumers.

Alan McQuaid, chief economist at Dublin-based stockbroker Bloxham, says the EU shouldn’t impose such rigid limits on weak economies. Ireland should shoot for 2020 instead of 2014, he says. «These are unusual times, and we need to adjust policy accordingly.»

—Neil Shah

Bono a 10 años.

Stephanomics, BBC blog.

Déficit.

Stephanomics, BBC blog.

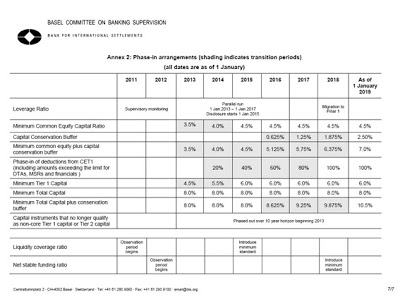

TABLE: Basilea III (2013-2019)

Basel Comittee on Banking Supervision

Bank For International SettlementsEl Grupo de Governadores y las Cabezas de Supervisión (27 países miembros, Trichet presidente) elevaron los criterios mínimos de capital para la banca el pasado 12 de septiembre.

Reformas de capital desde 2013 hasta 2019.

La banca dice que las medidas retrasarán la salida de la crisis. Más normativa, calendario corto, ajuste severo.

Existió un Basilea I y un Basilea II, que no evitaron el colapso de Japón en 1990, ni las crisis posteriores y menos aún la caída de Lehman Brothers en 2008 y sus consecuencias.

– Mayores requerimientos de capital (Common Equity Capital Ratio).

Del 2% al 4,5% para 2018.

El capital que debe reservarse frente a las pérdidas.

– Conservation Buffer: un colchón adicional del 2,50% para 2018

– Common Equity plus capital conservation buffer: la suma de los dos apartados anteriores.

Unas reservas del 7% para 2019. Menos dividendos, viajes y bonos.

– Tier 1, del 4% al 6%

Indicador sobre la seguridad bancaria.

The Basel Committee on Banking Supervision provides a forum for regular cooperation on banking supervisory matters. It seeks to promote and strengthen supervisory and risk management practices globally. The Committee comprises representatives from Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Hong Kong SAR, India, Indonesia, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, Russia, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States.

The Group of Central Bank Governors and Heads of Supervision is the governing body of the Basel Committee and is comprised of central bank governors and (non-central bank) heads of supervision from member countries. The Committee’s Secretariat is based at the Bank for International Settlements in Basel, Switzerland.

The Bank for International Settlements

The Bank for International Settlements (BIS) is an international organisation which fosters international monetary and financial cooperation and serves as a bank for central banks.

The BIS fulfils this mandate by acting as:

•a forum to promote discussion and policy analysis among central banks and within the international financial community •a centre for economic and monetary research •a prime counterparty for central banks in their financial transactions •agent or trustee in connection with international financial operations

The head office is in Basel, Switzerland and there are two representative offices: in the Hong Kong Special Administrative Region of the People’s Republic of China and in Mexico City.

Established on 17 May 1930, the BIS is the world’s oldest international financial organisation.

As its customers are central banks and international organisations, the BIS does not accept deposits from, or provide financial services to, private individuals or corporate entities. The BIS strongly advises caution against fraudulent schemes.

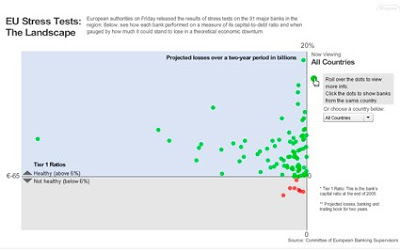

GRAPHICS: Test de Stress, WSJ

Grande interactivo de WSJ sobre los test de stress a la banca.

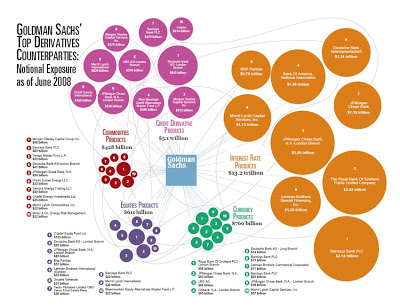

GRAPHICS: Hipotecas, en el abismo financiero

Hearing & Testimony

Financial Crisis Inquiry Commision

The Role of Derivatives in the Financial Crisis

Exposición de los derivados de Goldman Sachs

Los paquetes financieros realizados con el mercado de las hipotecas y luego reempaquetados, amplificando su valor y aumentando su riesgo.

De un valor original de 15 millones de dólares, se mezcla con valores basura, se vuelve a empaquetar (CDO) resultando un valor de 85 millones de dólares.

Su nombre: Glacier Funding CDO 2006-4A C Tranch.

Apalancamiento negativo y positivo.

La relación entre el capital propio y el crédito invertido en una operación finaciera. Mayor apalancamiento, mayor riesgo. Sin apalancamiento no hay beneficios.

La relación entre el endeundamiento al realizar una inversión (intereses a pagar) y los ingresos obtenidos.

Goldman Sachs niega su responsabilidd en el colapso de AIG en 2008.

Una explicación en Invertia.

‘Goldman estuvo entre los bancos estadounidenses y europeos que compraron a AIG protección contra el cese de pagos en créditos, y a los que se pagó rápidamente después de que el Gobierno estadounidense rescató a AIG en septiembre del 2008.

Los seguros conocidos como swaps por incumplimiento de pagos de créditos (CDS, por la sigla en inglés) dependían del desempeño de los paquetes de obligaciones colateralizadas de deuda (CDO, por la sigla en inglés), que incluían hipotecas de alto riesgo.

Como el valor de las hipotecas cayó en el 2007, los compradores de CDS comenzaron a pedir a AIG que pagara.

El ejecutivo de AIG, Elias Habayeb, dijo al comité que AIG trató de negociar con Goldman y otras contrapartes para limitar sus demandas, pero con poco éxito.

«Desafortunadamente AIG tenía poco poder de negociación», dijo Habayeb. Incluso si AIG iba a la bancarrota, las contrapartes obtendrían una protección especial por las leyes de bancarrota.

A marzo del 2009, Goldman había recibido 12.900 millones de dólares, de los 93.000 millones de dólares del dinero pagado a las contrapartes de AIG, más que cualquier otro banco’.

EFE:

‘Las autoridades reguladoras de Estados Unidos evitaron que los bancos a los que American International Group (AIG) aseguró millones de dólares en valores aceptaran pérdidas cuando se rescató a la aseguradora, por lo que esas entidades fueron las más beneficiadas en ese rescate’

TNYT:

‘The collapse of A.I.G., once the world’s largest insurer, and its dealings with Goldman and other major banks in the months leading up to that failure, have been the subject of significant Congressional interest since it was bailed out by taxpayers in the fall of 2008.

Under the terms of the $182 billion rescue, which was overseen by the Federal Reserve Bank of New York and the Treasury, the banks that had insured mortgage securities with A.I.G. were made whole on those contracts when they agreed to unwind them. Some $46 billion of the A.I.G. bailout money went to those banks. ‘