Basel Comittee on Banking Supervision

Bank For International SettlementsEl Grupo de Governadores y las Cabezas de Supervisión (27 países miembros, Trichet presidente) elevaron los criterios mínimos de capital para la banca el pasado 12 de septiembre.

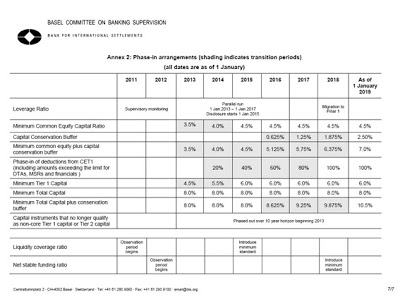

Reformas de capital desde 2013 hasta 2019.

La banca dice que las medidas retrasarán la salida de la crisis. Más normativa, calendario corto, ajuste severo.

Existió un Basilea I y un Basilea II, que no evitaron el colapso de Japón en 1990, ni las crisis posteriores y menos aún la caída de Lehman Brothers en 2008 y sus consecuencias.

– Mayores requerimientos de capital (Common Equity Capital Ratio).

Del 2% al 4,5% para 2018.

El capital que debe reservarse frente a las pérdidas.

– Conservation Buffer: un colchón adicional del 2,50% para 2018

– Common Equity plus capital conservation buffer: la suma de los dos apartados anteriores.

Unas reservas del 7% para 2019. Menos dividendos, viajes y bonos.

– Tier 1, del 4% al 6%

Indicador sobre la seguridad bancaria.

The Basel Committee on Banking Supervision provides a forum for regular cooperation on banking supervisory matters. It seeks to promote and strengthen supervisory and risk management practices globally. The Committee comprises representatives from Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Hong Kong SAR, India, Indonesia, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, Russia, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States.

The Group of Central Bank Governors and Heads of Supervision is the governing body of the Basel Committee and is comprised of central bank governors and (non-central bank) heads of supervision from member countries. The Committee’s Secretariat is based at the Bank for International Settlements in Basel, Switzerland.

The Bank for International Settlements

The Bank for International Settlements (BIS) is an international organisation which fosters international monetary and financial cooperation and serves as a bank for central banks.

The BIS fulfils this mandate by acting as:

•a forum to promote discussion and policy analysis among central banks and within the international financial community •a centre for economic and monetary research •a prime counterparty for central banks in their financial transactions •agent or trustee in connection with international financial operations

The head office is in Basel, Switzerland and there are two representative offices: in the Hong Kong Special Administrative Region of the People’s Republic of China and in Mexico City.

Established on 17 May 1930, the BIS is the world’s oldest international financial organisation.

As its customers are central banks and international organisations, the BIS does not accept deposits from, or provide financial services to, private individuals or corporate entities. The BIS strongly advises caution against fraudulent schemes.